What does the future hold for business? Ask nine experts and you’ll get ten answers.

It’s a bull market. It’s a bear market. Rates will rise or fall. Inflation’s up or down. Can someone invent a crystal ball?

Over 43,000 businesses have future-proofed their business with NetSuite, by Oracle - the number one AI cloud E.R.P., bringing accounting, financial management, inventory, and HR, into one platform. With real-time insights and forecasting, you’re able to peer into the future and seize new opportunities. Whether your company is earning millions or even hundreds of millions, NetSuite helps you respond to immediate challenges and seize your biggest opportunities.

Download the CFO’s Guide to AI and Machine Learning for FREE.

At the bottom of this post you’ll get a quick round up on who’s taking the CFO seat at PE-backed companies. Scroll down for the latest from Crusoe, Universal Background Screening, and MoneyGram.

What’s a Stalking Horse Bid?

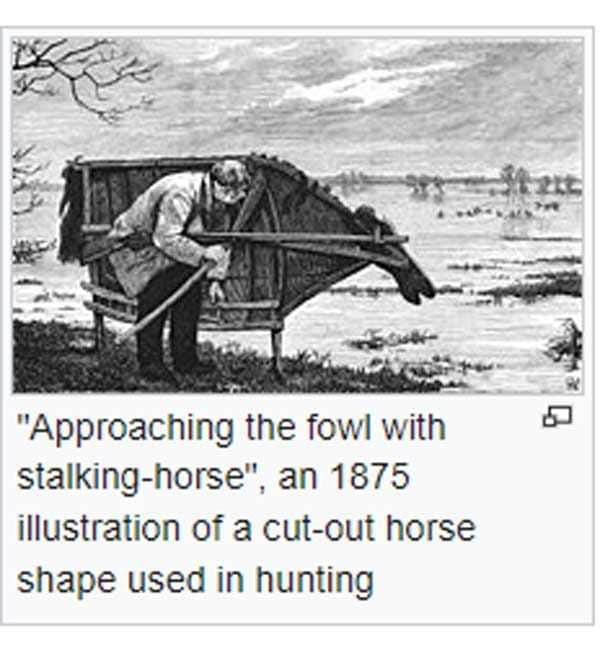

The origin of the term “stalking horse” comes from hunting, where in the 16th century hunters realized that fowl (birds) were spooked by humans, but you could get much closer if you hid your head and torso behind a horse. It became a clever way to sneak up on your prey (Source: Docket).

The term is used most commonly in bankruptcy proceedings. It’s the opening bid to set a reasonable floor and prevent a “naked” auction from occurring where someone walks away with a total steal. Ideally it gets the auction process moving and attracts other qualified buyers.

In return for throwing the first number out there, the stocking horse bidder gets extra incentives, like a promise of breakup fees and deal expenses paid back if it doesn’t go through.

“For example, a topping fee (which needs to be paid when the stalking horse is outbid) or breakup fee that is disproportionately high relative to the total asset value could force other bidders to exceed the stalking horse bid by an amount so large that the deal becomes uneconomical to the next bidder.”

To make that more real, imagine a debtor selling a used car where the stalking horse bidder offers $3,000 below the blue book market value, but requests a $4,000 breakup fee. Pretty good business if you win or lose.

While the whole idea is to encourage competition, it doesn’t always result in the intended outcome. One example that comes to mind is the sale of Bed Bath and Beyond. To kick off the bankruptcy proceedings, Overstock.com threw a bid in… but no on else showed up. As a result, they won the auction with their low ball offer. Woops.

While the term is traditionally used in bankruptcy proceedings, the same concept can be more loosely applied in non bankruptcy M&A situations.

The term is being throw around right now with the Warner Brothers - Netflix acquisition, with some analysts calling Paramount’s takeover bid merely a stalking offer. While I don’t fully buy it, as Parmount’’s bid seems like a true hostile takeover attempt, it forces Netflix to reach deeper into their pockets to ensure they win the deal.

If we tie this back to middle market private equity deals, when a company decides to run a process (or the always believable “non-process process”) bankers will try to get someone to throw a non binding offer (IOI) in, even if the company never intends to end up with that party. On one hand, yes, the number they write down is important, but past a certain threshold, it’s secondary. The real value is the FOMO it generates, and the forward momentum it unlocks.

This usually takes the form of bankers quietly floating the idea to friendly biz dev teams they know are hungry to spend some money and look busy.

Once they have an IOI in hand, they’ll take it to companies whom they want to jolt into action, framing it as if the target wasn’t even in market, but received a compelling offer that will, in the interst of shareholders, necessitate the need to kick off a more formal process.

To put it in banker speak, they may communicate something like:

“The Company has received a high-confidence, non-binding indication of interest from a sophisticated financial sponsor with significant sector expertise. The valuation range of this expression of interest is consistent with our expectations and is being used as a benchmark for evaluating additional parties.”

Even better if the stalking horse is a well known competitor.

There are some real risks of running this playbook, of course. The biggest is burning a good partner. If you go to someone in your ecosystem who currently helps you make money, and they find out they were essentially used to drum up interest, there could be bad blood. And that could hurt your revenue potential down the line for when you do actually line up a qualified buyer.

The other risk is simply appearing like you are in market too much. You don’t want to be doing this every six months. It will come across as less of an opportunistic situation for real buyers, and more the desperate boy who cried wolf.

Be careful which narratives you promote, and which wolf (or horse) you feed.

Leveraged Moves

Recent C-suite shifts across the private equity landscape… because people moves are performance levers too.

Crusoe announced Micheal Gordon as CFO and chief operating officer. Previously, Gordon was CFO and COO of MongoDB where he grew revenue nearly 50-fold and led the company’s IPO. Crusoe recently secured $1.4B Series E, reaching a $10B valuation to accelerate its vertically integrated AI infrastructure. The round was co-led by technology investors Valor Equity Partners and Mubadala Capital.

Universal Background Screening (UBS) announced the appointment of Claire Martin as CFO. Martin brings more than two decades of global financial leadership experience across high-growth SaaS, e-commerce and tech organizations, including Bestow, Wonderbill, Seatwave, King, Yahoo! and Monster. UBS was acquired by SNH Capital Partners in 2019.

MoneyGram named Marc Winniford, a Wells Fargo finance executive, as CFO come February. Winniford has served as CFO of Wells Fargo’s corporate and investment back since 2022. The appointment comes at a transitional time for MoneyGram, which is looking to upgrade operations after being taken private in a $1.8B deal with Madison Dearborn Partners in 2023.

Thanks for reading, and make sure to check out our sponsor, NetSuite.

Download the CFO’s Guide to AI and Machine Learning for FREE.