What does the future hold for business? Ask nine experts and you’ll get ten answers.

It’s a bull market. It’s a bear market. Rates will rise or fall. Inflation’s up or down. Can someone invent a crystal ball?

Over 43,000 businesses have future-proofed their business with NetSuite, by Oracle - the number one AI cloud E.R.P., bringing accounting, financial management, inventory, and HR, into one platform. With real-time insights and forecasting, you’re able to peer into the future and seize new opportunities. Whether your company is earning millions or even hundreds of millions, NetSuite helps you respond to immediate challenges and seize your biggest opportunities.

Download the CFO’s Guide to AI and Machine Learning for FREE.

Payments Unlocking Value

If you ask ten product managers what they think finance can do to unlock innovation you’ll get ten different answers…

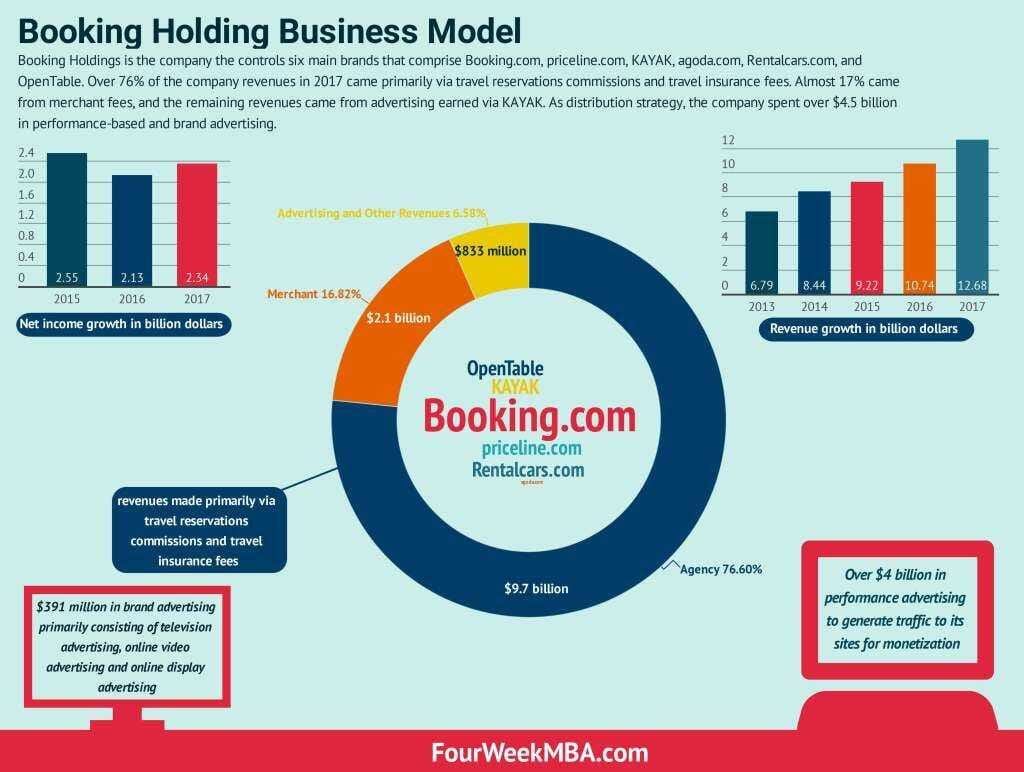

I was listening to Ben Thompson’s Stratechery podcast where he interviewed the CEO of Booking.com, Glen Fogel. Booking.com is the world’s largest online travel agency and the largest platform for booking accommodation. But it didn’t always start that way. It started as a company called Priceline. And they had to unseat a massive competitor in Expedia.

At the core of the discussion was the difference between an agency model and a merchant model.

In early 2000, the 800 pound gorilla was Expedia. They built their entire P&L around the merchant model.

How it worked was when you go to Expedia’s site, you put your credit card in to book a room and you are charged on the spot. Your trip could be five months out, but you pay for the deal you want right then and there.

The cash leaves your account and goes to Expedia’s account.

But here’s the catch - the hotel itself doesn’t receive their portion of the payment, around 80%, until AFTER the visitor shows up and stays.

Even worse, that payment might come another 30 days after the person stays there.

Awesome for Expedia, as they can live off the float (ALL of the float, including the portion that’s not theirs to keep). Terrible for the hotels, many of which are small family owned locations through Europe, who are dying from a cash flow perspective.

And the situation was even more dire if you were, counterintuitively, doing well.

The faster you grew, the worst your negative cash flow can get worse, worse, worse, worse, worse.

Here’s how Booking.com attacked the float Expedia was living off of, and unlocked billions in GMV.

The Expedia Model: Float is King

Back in the early 2000s, Expedia was the dominant player in online travel. Their model was pretty simple:

You, the traveler, book a hotel.

Expedia charges your credit card immediately.

Then weeks later, Expedia pays the hotel.

They never technically “owned” the hotel room, but they held onto the cash in the meantime. This is called the merchant model - and the float (that time gap between cash-in and cash-out) was hugely valuable. It funded operations. It propped up the P&L. And it became embedded into how the entire business ran.

Hotels hated it. They got paid weeks after the customer stayed. No recourse. No flexibility. But Expedia had the traffic, so they put up with it. It was the devil they knew.

Enter Booking.com: Same Industry, Different DNA

Meanwhile, a much smaller company in Europe, Booking.com, was doing something completely different.

They used the agency model:

The traveler booked on Booking.com

But they paid the hotel at check-in

After the stay, the hotel would pay Booking.com a commission

Booking never touched the customer’s money. They just matched supply and demand, and prayed the hotel would send them a check afterward.

This flipped the cash flow dynamic completely. Hotels loved it. But it was a nightmare for Booking’s own working capital.

Why? Because Booking still had to pay Google up front for the traffic, but wouldn’t see any revenue until weeks (or months) later, assuming the hotel even paid. And a lot of hotels just… didn’t. They’d ghost. No invoice system. No enforcement. No float. No leverage.

So Booking was stuck. Great model for growth. Terrible model for cash.

Priceline Buys Booking, and Gets a Business Model in the Deal

In 2005, Priceline (which had also started out with its own quirky merchant model) acquired Booking.com. Most companies would’ve swallowed the startup and forced them onto the parent’s system.

But Priceline did something smarter. They leaned into the agency model.

Why?

Because even though it was painful in the short-term, the agency model let Booking scale way faster on the supply side.

Hotels didn’t need a formal agreement. No prepayment. No crazy systems. Just upload your photos, set a price, and you were live.

The merchant model was a cash machine, sure.

But the agency model was a growth engine.

Scaling the Supply Side Wins the Game

The dirty little secret of marketplaces is that supply-side scale unlocks everything.

More hotel options = better consumer experience

Better consumer experience = more bookings

More bookings = more leverage with suppliers

More leverage = better margins, better terms, better defensibility

But you can’t get there if your model slows down supplier onboarding. And that’s what the merchant model did.

Booking grew fast because their terms were friendlier. And once they hit critical mass, and had actual negotiating power, they started reintroducing merchant-style flows selectively, where it made sense.

Today, more than 15% of Booking’s revenue comes from merchant-style transactions. The difference? They have the scale, data, and infrastructure to handle it now.

What This Means for Operators

This isn’t just a travel industry story.

It’s a playbook for anyone building a B2B marketplace, embedded fintech layer, or multi-sided platform. And the big unlock is this:

Your cash flow model is your business model.

Too many companies let finance figure this out after the fact. But the best operators design it up front.

Here are a few lessons I took from the Booking story:

Payment terms can attract (or repel) supply

If you’re in a supply-constrained market, paying fast (or just getting out of the way) might beat offering the best rev share.

Cash conversion cycles = competitive strategy

Float isn’t just a treasury tool. It’s a growth lever. Or a trap, if you’re not careful.

You can always reintroduce float later

Use agency to scale. Use merchant to monetize. Don’t get dogmatic; get strategic.

Own the rails

Booking now supports 40+ payment types. You can pay in Chinese yuan, and they’ll deposit euros into a French hotel’s account. That’s not just convenience. That’s margin and defensibility.

Your cost of capital is someone else’s choke point

If you can front the money and they can’t, you win. If you can wait to get paid and they can’t, you win. Use that.

Final Thought

When people ask me what gives a company leverage, I usually talk about operating metrics: pricing power, retention, margin expansion, CAC payback.

But payment terms? That’s leverage in its purest form.

Cash flow timing changes the way a business feels to everyone in the value chain, and when you get it right, it’s not just a finance decision. It separates first place from second place.

Booking.com figured that out. The question is: have you?

Thanks for reading, and make sure to check out our sponsor, NetSuite.

Download the CFO’s Guide to AI and Machine Learning for FREE.