We all know that bad data in = bad data out.

When contract data is unstructured, everything downstream suffers.Manual billing and invoices, messy spreadsheets, and hours of reconciliation that never quite tie out.

Tabs fixes that.

We’re the AI-native revenue platform that automates the entire contract-to-cash cycle. Whether you're selling custom terms, usage-based pricing, or a mix of PLG and sales-led, Tabs turns month-end chaos into clean cash flow.

✅ Instantly generates invoices and revenue schedules from complex contracts✅ Automates dunning, revenue recognition, and cash application✅ Syncs clean, structured data across your ERP and reporting stack

Trusted by companies like Cortex, Statsig, and Cursor, Tabs powers the finance teams behind the next wave of category leaders.

👋 Hi, it’s CJ Gustafson and welcome to Looking for Leverage. Each edition dives into the real-world playbooks PE-backed execs use to drive results.

Today we’re talking about org complexity, and how it’s a lot harder to forecast than revenue. Especially when you add M&A to the mix… Let’s get to it.

It’s tempting to think that scaling a company means making your business model more complex. You add SKUs, expand channels, localize pricing, maybe dip your toe in the enterprise pool.

But here’s the thing: the model is usually the easy part.

The real complexity creeps in through the people. Every new person adds a node to your system, and with them come more meetings, more approvals, more misunderstandings. Your forecast may look linear, but your org chart is growing geometrically.

1. Metcalfe’s Law has entered the chat

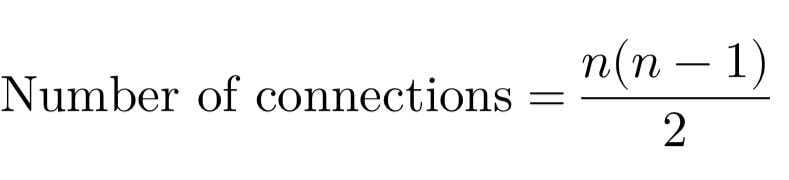

Metcalfe’s Law says the value of a network is proportional to the square of the number of connected users.

That might be true for social platforms, but in company-building, the opposite trend rips: complexity scales faster than value.

A 10-person startup has 45 potential lines of communication. A 100-person company? 4,950.

Now imagine layering in not just more people, but also more functions, geographies, and business units.

That’s what Sanjay Datta, CFO of publicly traded lending analytics platform Upstart, saw firsthand earlier in his career while at Google. He scaled it’s ads business from $1 billion in revenue to $80 billion.

“Google added YouTube. Then it added the Cloud Business. And Display Advertising. Then it got into hardware. You end up with a three-dimensional matrix of product lines, geographies, and functions.”

What broke wasn’t the model. Ads were still ads, whether it was a $1B or $100B business.

“The complexity came when I had to manage across the YouTube team trying to sell ads in Europe, a marketing lead in Europe, and a CMO in Mountain View. It was the communication system that broke, not the business model.”

This cracked me up, as I expected the ad business to become exponentially harder to forecast at scale. If anything, it was even more predictable. There was now historical data to rely upon, and customers had been using Google long enough where they’d ramp activity in predictable ways.

Unfortunately though, the people running around trying to hold that platform together were anything but predictable.

2. Scaling Business ≠ Scaling Headcount

We act like growth is just a matter of hitting repeat: launch new stuff, hire more people.

But while business models scale linearly, organizational complexity scales exponentially. At some point, you’re not scrappily building anymore; you're managing across functions, across time zones, across incentive structures.

That’s when you stop being a functional leader and start becoming the CEO of a business unit. Your calendar turns into a jigsaw puzzle of cross-functional check-ins, skip-level one-on-ones, and alignment sessions (I think that’s what Brian Chesky meant by going “founder mode”… just like, talking to the people who don’t report to you. I digress…)

Sanjay explained:

“At some point you break the functional hierarchy and you become a company of business units. You’re no longer doing the work directly. You’re leading teams that lead teams.”

3. The Org Chart Is a Living Forecast

We treat the org chart like it’s a static document. It’s not. It’s a living, breathing network, and it needs to be forecasted just as rigorously as revenue.

Every reorg, every team split, every new VP creates second-order effects. Yet most planning processes still model financial inputs like CAC and churn, while completely ignoring coordination costs.

Want to know where your next planning cycle will break down? Don’t look at your margins. Look at how many people need to agree to change one KPI (yes, we’ve all been in those conference rooms where we debate the definition of a customer for 45 minutes). And look at your reporting ratios. A sales manager with 17 direct reports? A CEO with 23 direct reports? Unless you’re Jensen Huang, good luck.

4. M&A has entered the chat

Just when we were getting somewhere… we had to go and complicate things!

Well, scaling through hiring is one thing. Scaling through acquisition? That’s going from evolution to mutation. And if your org can’t metabolize that mutation, it’ll reject the host.

In PE-backed businesses, M&A isn’t a “nice to have”—it’s a board-mandated milestone. And yet, most failed deals don’t die because the investment thesis was flawed. They die because the integration plan was.

We tell ourselves these deals are about TAM expansion. Strategic fit. Channel leverage. But the part we tend to skip? The org chart.

Because when you buy a company, you're not just inheriting product lines. You’re inheriting communication systems. Hierarchies. Power centers. Calendars full of standing meetings with acronyms you don’t recognize.

And unlike headcount growth, you don’t get to phase it in. You inject a fully formed second company into your network overnight—with zero shared context, no default trust, and a whole new set of “owners” for KPIs.

One CFO I worked with had a rule: “Before we close, can you draw the new org chart from memory?”

If the answer was no, we weren’t ready.

Because the moment the deal closes, everyone in both companies starts asking the same questions:

Who do I report to?

Who signs off?

Whose roadmap wins?

And if you can’t answer those questions before day one, you’ll spend the next six months spinning wheels, running dual systems, and wondering why the metrics look worse even though the market opportunity just got bigger.

This is why M&A isn’t just a financial decision; it’s an org design challenge. And most of us are still treating it like a spreadsheet exercise instead of a systems map.

📋 Are You Org-Ready for That Acquisition?

Before you model the revenue uplift, sanity check the org chart risk. Ask yourself:

Can you draw their org chart from memory?If not, you don’t understand the power dynamics you're about to inherit.

Who will own the overlapping functions?Be precise. “We’ll figure it out post-close” is not a strategy; it's a retention risk.

Do you know how decisions are made in their org?Not what the deck says. What actually happens when something breaks?

🔁 If you can’t answer at least two of these, hit pause on the synergies slide.

5. More People, More Problems

Ok, back to my main point. I’ve always thought a team of 15 to 20 assassins could outproduce a team of 150 to 200 good workers. I’ve lived through org transformations where we were scaling so fast—20 to 30 new people per month—that every 100 hires felt like birthing a new company.

The culture doesn’t scale as gracefully as you hope. Neither do the methods of communication. People feel left out of the loop—right, wrong, or indifferent.

With some space to reflect, I’ve realized: we forecasted revenue growth with maniacal precision. And we forecasted communication like it was an afterthought.

And that’s where the real complexity came from.

Here’s my interview with Sanjay where we discuss the complexities of scaling an org.