What the Rise of Direct Lending Actually Means for PE-Backed Operators

More optionality? Or a tighter leash?

What does the future hold for business? Ask nine experts and you’ll get ten answers.

It’s a bull market. It’s a bear market. Rates will rise or fall. Inflation’s up or down. Can someone invent a crystal ball?

Over 43,000 businesses have future-proofed their business with NetSuite, by Oracle - the number one AI cloud E.R.P., bringing accounting, financial management, inventory, and HR, into one platform. With real-time insights and forecasting, you’re able to peer into the future and seize new opportunities. Whether your company is earning millions or even hundreds of millions, NetSuite helps you respond to immediate challenges and seize your biggest opportunities.

Download the CFO’s Guide to AI and Machine Learning for FREE.

We’re trying something new: Leveraged Moves — a quick hit of who’s taking the CFO seat at PE-backed companies. Scroll down for the latest from Preply, Panera Bread, and Sky Zone.

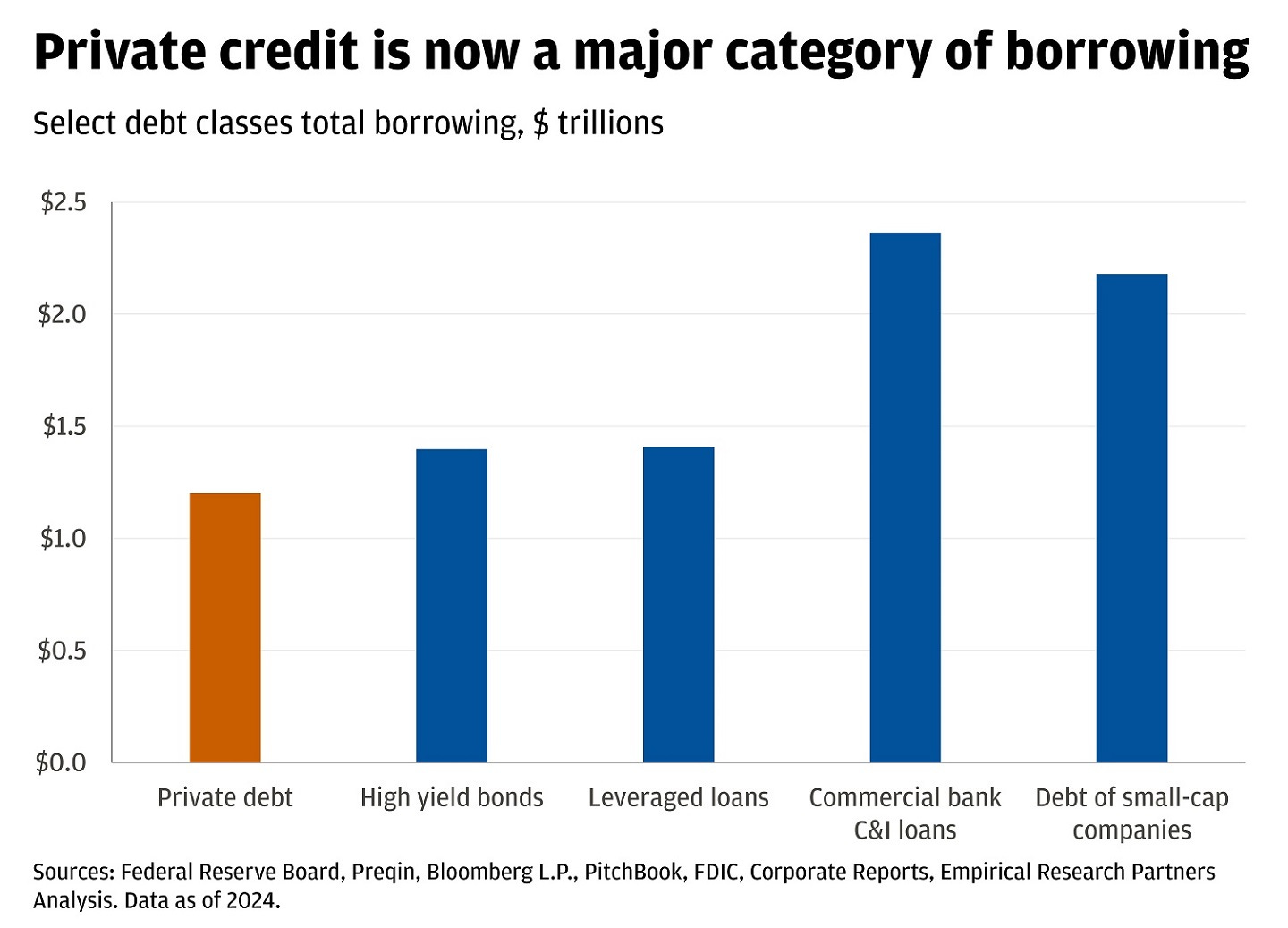

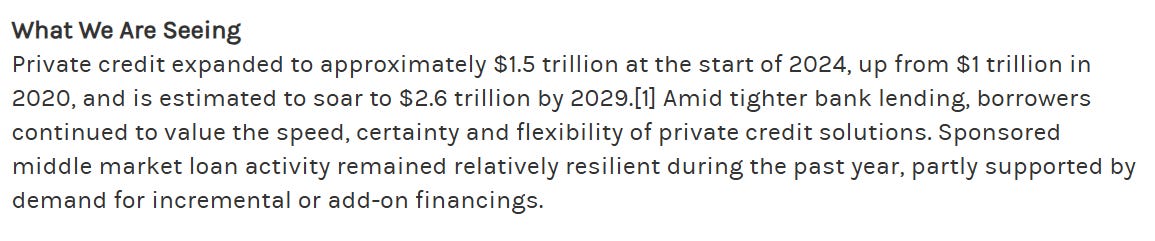

You’ve probably seen the headlines:

“Private Credit AUM Approaches $1.5 Trillion”

“Blackstone Raises Record Direct Lending Fund”

“Banks Are Out… Private Lenders Are In”

From the surface, it sounds like good news for anyone running a PE-backed business: more lenders, more capital, more optionality.

But if you’re an operator, especially a CFO, the rise of private credit isn’t a blank check. It’s a structural shift in who’s holding the risk, how deals get papered, and what they expect from you once the money lands.

Let’s break down what’s actually changed, and what it means if you’re operating under one of these capital structures.

From Banks to Direct Lenders: What Actually Changed

The biggest shift over the past decade is who’s providing the debt.

In the past, leveraged loans came from banks. They’d underwrite, syndicate, and step back. Today, a growing share of deals, especially in the middle market, are being funded by private credit funds that hold the entire position and stay involved.

These are firms like:

Ares

Blackstone Credit

HPS

Owl Rock

Sixth Street

Blue Owl

They look like asset managers, but they behave like lenders. And they care a lot more about what happens post-close than traditional banks ever did.

The Good News

Let’s start with the upside. Private credit has made some things easier:

More flexible terms: You can negotiate bespoke structures, not just standardized loan docs.

Faster execution: No need to syndicate or market the deal to a big lender group.

Wider deal funnel: Sponsors can finance deals that banks would’ve passed on — messy carveouts, asset-light companies, volatile EBITDA.

For operators, that can mean:

Smoother closing process

Better alignment between sponsor, lender, and management

More creativity around liquidity, dividends, or acquisition funding

The Tradeoffs: What Operators Need to Watch

Now the part nobody tells you in the press release:

1. You’re dealing with one counterparty… and they have teeth.

There’s no BAML or JPM in the background. These funds are sophisticated, aggressive, and often former distressed debt investors. If things go sideways, they’re not afraid to step in and protect their downside.

If you throw the keys on the table and (try to) walk away, they can actually drive the car.

2. Covenant-lite ≠ Covenant-free.

While private lenders can offer flexibility, they also expect more frequent reporting, tight communication, and real-time updates on performance. Missed numbers or unapproved moves can trigger major friction.

While not as in your shorts, it’s probably closer to your PE fund’s weekly reporting cycle than a once per quarter check in.

3. It’s not always cheaper.

Private credit is usually more expensive than syndicated debt — sometimes by hundreds of basis points. You’re trading flexibility for price. In a higher-rate world, that interest burden hits your P&L fast.

4. They stay close.

Unlike banks who fade into the background, direct lenders stay in the mix. They read your board decks. They model your performance. And they can influence follow-on financing decisions (e.g. add-ons, refis, delayed draws).

Implications for Operators

If you’re the CFO or COO of a PE-backed company funded by private credit, here’s what this means for you:

1. Forecasting gets real(er)

You need to hit your base case. Not just for equity returns, but to stay in compliance and maintain flexibility (and keep ya job). Direct lenders are tracking your numbers just as closely as the sponsor is.

2. Comms cadence matters

Get ahead of bad news. Lenders hate surprises. Create a rhythm of communication (monthly flash reports, quarterly business reviews) that shows you’re in control and a steady hand on the wheel, even when the numbers aren’t perfect.

3. Free cash flow is the new king

Forget ARR. Forget GAAP net income. Private lenders care about cash flow available to service debt. They will not jump up and down for high fives over modest net new ARR gains like your current investors might. Make sure your reporting stack includes a clear, consistent FCF bridge. That ties.

4. Liquidity planning is now your job

You can’t just hope for a revolver draw or sponsor backstop. Build a 13-week cash flow. Know your minimum liquidity covenant. Be able to explain every swing in your cash balance.

The New Operator Reality

In the old model, you got a bank loan and dealt with the back office. In the new world, your lender is:

Your capital partner

Your second-most important audience, after the sponsor (1a and 1b)

Your fastest path to additional capital, or your biggest constraint

Private credit has made more deals possible. But it’s also introduced a higher standard of financial maturity earlier in the lifecycle of a company.

If you’re not ready to manage debt proactively, it’s not a lifeline; it’s a leash.

Here to Stay (Until it Isn’t)

Private credit is here to stay, unless it blows itself up (which honestly could happen). It’s more sophisticated, more responsive, and often more founder-friendly than the old school bank model.

But don’t confuse availability with leniency.

More capital in the system doesn’t mean more forgiveness. It just means the people holding the debt are closer to your business, and expect more from you.

Leveraged Moves

Recent C-suite shifts across the private equity landscape… because people moves are performance levers too.

Global language-learning marketplace Preply, backed by Horizon Capital ($1.6B AUM) and Owl Ventures ($2.2B AUM), appointed Charlie Wickers as Chief Financial Officer. Wickers spent the past eight years at Rover, the online marketplace for pet care, most recently serving as CFO. Preply was last valued at approximately $400M and has raised $141M to date.

Panera Bread, majority-owned by JAB Holding Company ($40B+ AUM), named Earl Ellis as Chief Financial Officer. Ellis previously served as CFO of ABM Industries. JAB also owns brands including Dr Pepper, Keurig, and Krispy Kreme. Panera was acquired by JAB in 2017 for $7.5B and was reportedly valued at $10B following a private funding round in January 2024.

Indoor trampoline park operator Sky Zone, majority-owned by Palladium Equity Partners ($3.6B AUM), appointed Michael Healy as Chief Financial Officer. Healy joins from Bloomin’ Brands (parent of Outback Steakhouse, Carrabba’s Italian Grill, and Bonefish Grill) where he served as CFO and EVP of Global Business Development. Sky Zone franchises reportedly generate more than $800M in collective annual revenue.

Thanks for reading, and make sure to check out our sponsor, NetSuite.

Download the CFO’s Guide to AI and Machine Learning for FREE.