We all know that bad data in = bad data out.

When contract data is unstructured, everything downstream suffers.Manual billing and invoices, messy spreadsheets, and hours of reconciliation that never quite tie out.

Tabs fixes that.

We’re the AI-native revenue platform that automates the entire contract-to-cash cycle. Whether you're selling custom terms, usage-based pricing, or a mix of PLG and sales-led, Tabs turns month-end chaos into clean cash flow.

✅ Instantly generates invoices and revenue schedules from complex contracts✅ Automates dunning, revenue recognition, and cash application✅ Syncs clean, structured data across your ERP and reporting stack

Trusted by companies like Cortex, Statsig, and Cursor, Tabs powers the finance teams behind the next wave of category leaders.

The Holding Period Is Getting Longer—Here’s Why That Matters for You

Private equity’s average holding period isn’t just stretching—it’s bursting at the seams.

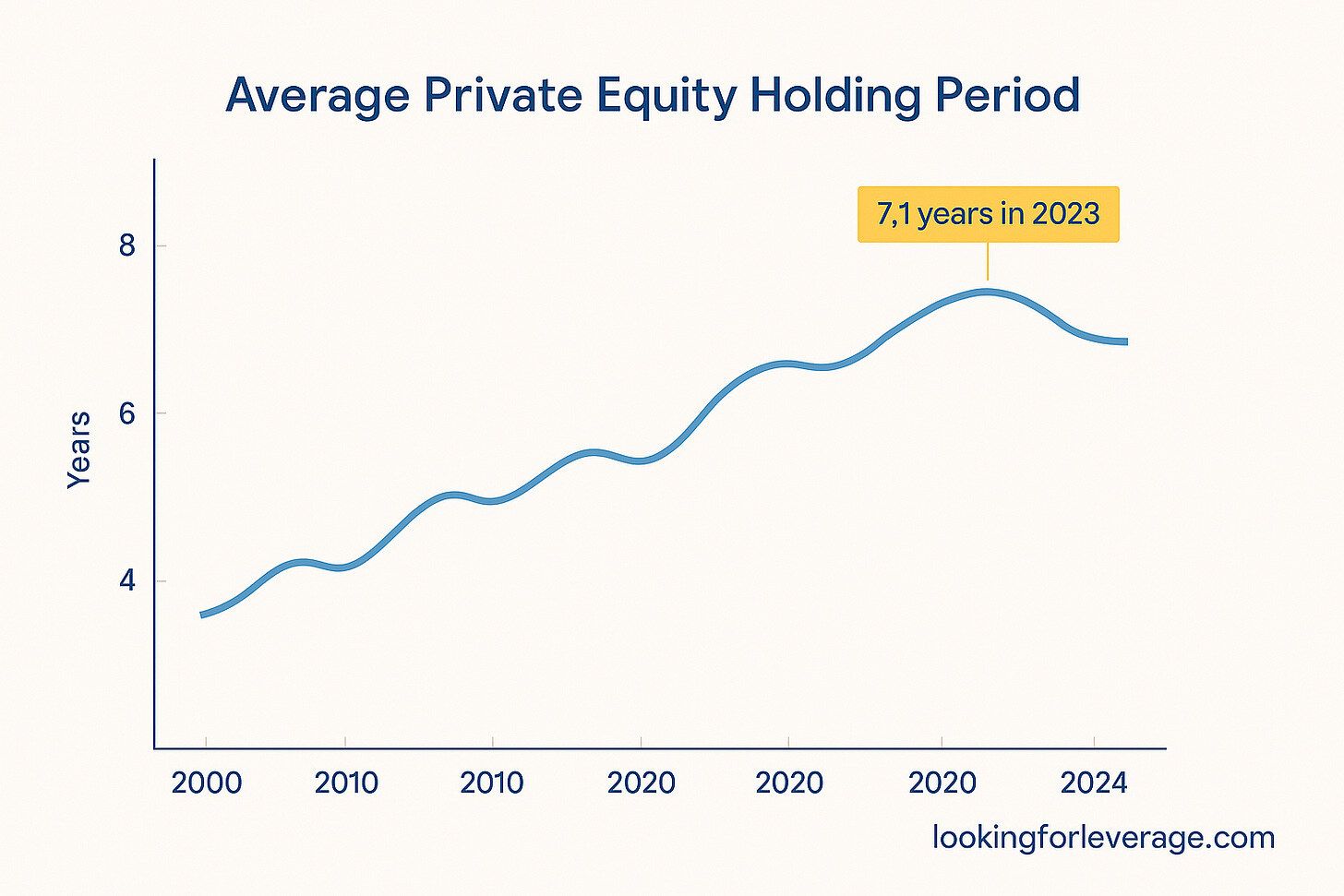

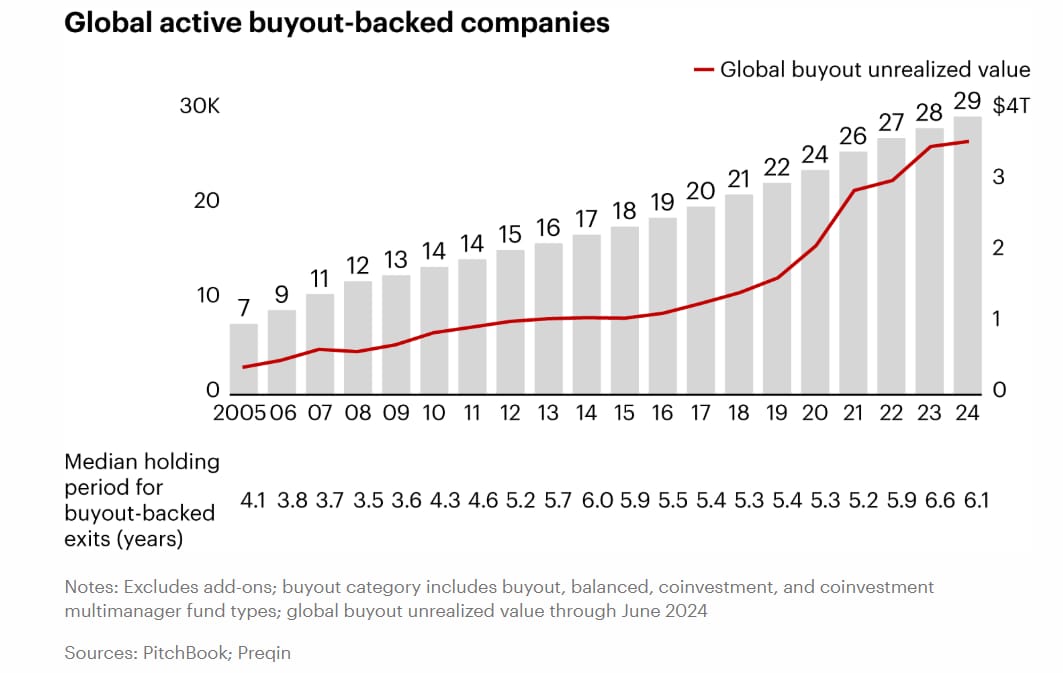

Globally, buyout holding periods peaked at 6.6 years in 2023, according to Bain. But in North America, the average climbed even higher—to 7.1 years, the longest since at least 2000 (S&P Global).

Even with some easing in early 2024—median hold times fell to 5.8 years—we’re still well past the old 3–5 year playbook. The era of quick flips is fading.

And as an operator, that changes your job.

PE-backed execs used to plan for a three-act arc: stabilize, optimize, exit. Now? You may be holding the bag for six, seven, even eight years—sometimes across multiple fund cycles or inside a continuation vehicle.

1. Pace Yourself (But Don’t Coast)

Old model: Go hard for 36 months, then dust your hands off.

New model: Build a durable operation that can withstand multiple valuation cycles. This isn’t just about “growing fast”—it’s about compounding efficiency over time. You need stamina, not stop-gap heroics. Because your next buyer might not show up until year six—or year eight.

This informs how you build your teams. You can’t hero sell your way to an exit with a few solid sales reps and a manager with 17 direct reports. And you can’t put things on your product roadmap solely to pique the next buyer’s interest. It becomes incumbent on you to do the work to actually get the company through another leg of the journey, not just look like it can roll into the next stop.

That means hiring leaders that can scale through multiple epochs of growth. Speaking of which…

2. Shift Your Planning Horizon

Like we said, you can’t just build for the exit deck. You need to build for sustainability. That means investing in infrastructure (ERP, data integrity, pricing systems) that won’t break in year four. It means org design that doesn’t collapse under the weight of a third re-org.

Unfortunately that means actually doing that NetSuite overhaul and moving onto an HRIS that tracks more than employee salaries and t shirt sizes

There’s a common joke that most CMOs last 18 months…

Join

Change logo

Overhaul website

Throw an expensive user conference with new colors

And attempt to build pipeline through shiny new marketing channels.

Then halfway through quarter seven of the journey the CEO and CRO realize it was all sizzle and no steak.

That can’t be the case if you’re trying to build pipeline not just for this year, but three years out.

3. Get Good at Recasting the Narrative

A longer hold period often means market conditions aren’t cooperating. And even if valuations rebound, the median PE hold still sits at nearly six years. That means you're not just pitching to exit—you’re pitching to extend. Strategic acquirers are sidelined. IPO windows are closed. And suddenly you’re pitching “Act II” of the value creation plan. You need a fresh narrative—one that keeps the board engaged and your leadership team aligned.

This links to what we talked about a few weeks back: Jumping S Curves. You need to ride multiple waves of growth. One product isn’t enough. That market will be saturated by year three or four, and the longer sales cycles punch you in the face in year five.

By the way - it’s critical for you, as a C Suite exec, to KNOW the valuation creation plan. It sounds silly to say, but many execs don’t ask their CEO to explain this to them (to be fair, it could also be the CEO’s not being forthcoming enough about it). The value creation plan should be something you ask about during your interview.

Alignment, especially when it shifts, is absolutely critical to not only ensure you hit the KPIs, but also protect your job. The fastest way to fall out of favor with a sponsor is to be rowing in the wrong direction when there are limited chips to put on the table (even if your internal GPS is right).

4. Manage Retention Like a Capital Allocation Problem

Burnout risk rises in year five (if it hasn’t hit by the full four year vest period is done). The average tenure of a C suite exec is around two and a half years.

So does key-person risk. Your best people will see LinkedIn recruiters in their inbox. Longer holds force you to think like a capital allocator: Who do you double down on? Where do you rotate talent? How do you make sure they have paths to grow within the company?

People development comes to the forefront if you want to keep talent focused through half a decade of promotion cycles.

5. Build for Optionality, Not Perfection

You don’t know when the exit will come—or through what channel. That means clean books, repeatable reporting, and a leadership bench that can survive due diligence without panic. Be exit-ready, always—but don’t bet the farm on a specific date.

As we said before - as a private equity backed company, you’re essentially always up for sale.

Bottom line:

You’re not just a transitional CEO/CFO/CRO anymore. On the spectrum of hired assassin and career General Electric employee, you’re slowly shifting to the latter. You’re the steady hand through multiple innings. And the firms that will outperform are the ones that don’t just chase exits—they build businesses that earn them.

And guess what? That’s the type of financial profile that earns premium multiples.

Learn something? Share this newsletter with a friend or colleague who works at a private equity backed company.