As we enter the final stretch of 2025, CFOs are under more pressure than ever to deliver forward-looking 2026 forecasts while also providing stakeholders with a clear, data-backed view of how this year has played out. I know how tough this is when fragmented data and error-prone spreadsheets create blind spots and make it hard to stand behind the numbers with confidence.

This white paper captures how 100+ PE-backed CFOs moved beyond spreadsheets, automated their Revenue Cube, and unlocked real-time intelligence that improved forecasting accuracy, delivered financial clarity, and elevated their role as trusted partners. Here’s what worked for them—and what can work for you as you prepare for 2026.

Get the roadmap to accurate forecasts and financial clarity

TAM Is the Floor, Not the Ceiling

Most pitch decks treat TAM like it’s

a) True

b) Inevitable

Both assumptions are, at best, suspect.

I know this is true, because I’ve done it on multiple occassions.

I call it “the big number thing”: Multiplying an astronomical figure times a small percentage and say LOOK, WE ONLY NEED 1%!!!!. Then we put it in a neat blue box and treat it like destiny.

Yet, a truth few realize: TAM is not an entitlement. It is not a guarantee of value.

(That’s the negative take on TAM.)

But the positive take is that it should not be the limit of your ambition (because many times, you can’t see it until you are there).

For operators building real businesses, especially in a private equity context, TAM should be treated as a floor, not a ceiling, in any product roadmap decisions.

It is the starting point to start allocating resources into a space. Not the endgame.

You Don’t Own TAM. You Earn the Right to Address It.

Just because a market is large does not mean your company deserves a slice of it. That market is already being served, imperfectly or otherwise. Your right to win even a small percentage of it must be earned; through product, pricing, distribution, support, brand, and a dozen other strategic choices.

A generous TAM might make the investment thesis easier to model. But on the ground, it does nothing for pipeline, product-market fit, or customer retention.

The question is not “how big is the market.” The question is, “what part of the market are we uniquely equipped to serve, and how do we expand that wedge over time?”

If you're a CFO in a PE-backed environment, this means shifting how you talk about TAM with your board:

Less focus on top-down market size

Instead, you need to do an honest Price x Quantity calc, from the bottom-up

More focus on your current serviceable segment

How many customers are realistically looking to purchase something this year? Don’t forget… it’s hard to fight the gravity of non-renewal years

And even more focus on how to expand that segment strategically over the hold period

How does addressing a certain TAM today allow you to go deeper by embedding yourself in specific workflows. Speaking of that…

The Real Value Is in Expanding TAM

Companies that create real enterprise value don’t just capture current market share. They expand the definition of what their market is.

If you look at vertical SaaS providers that start in a single niche (e.g., dental practice booking software), their TAM grows as they prove their model. They gradually earn the right to serve adjacent functions (product sourcing, insurance billing) or expand to parallel markets (chiropractors, optometrists, med spas).

Or look at a fintech platform that begins in payments, then layers in cash management, working capital, spend controls. It is not just cross-sell. It is TAM creation through product adjacency.

In each case, the team doesn’t start with “here’s our billion-dollar TAM.” They start with a narrow wedge, win deeply, and pull the market toward them. They earn expansion.

And as a result, many times the market pulls them along into new opportunities that they couldn’t have anticipated at the outset when they first did that TAM calculation.

For CFOs, this means aligning capital allocation to these expansion plays. It means funding the operational layers (pricing, compliance, integration, customer education) that allow the company to take more of the pie without diluting its margins or product clarity.

Here are three examples of companies that did exactly that: starting in narrow markets, then earning the right to stretch their TAM through deep customer understanding and boots-on-the-ground execution.

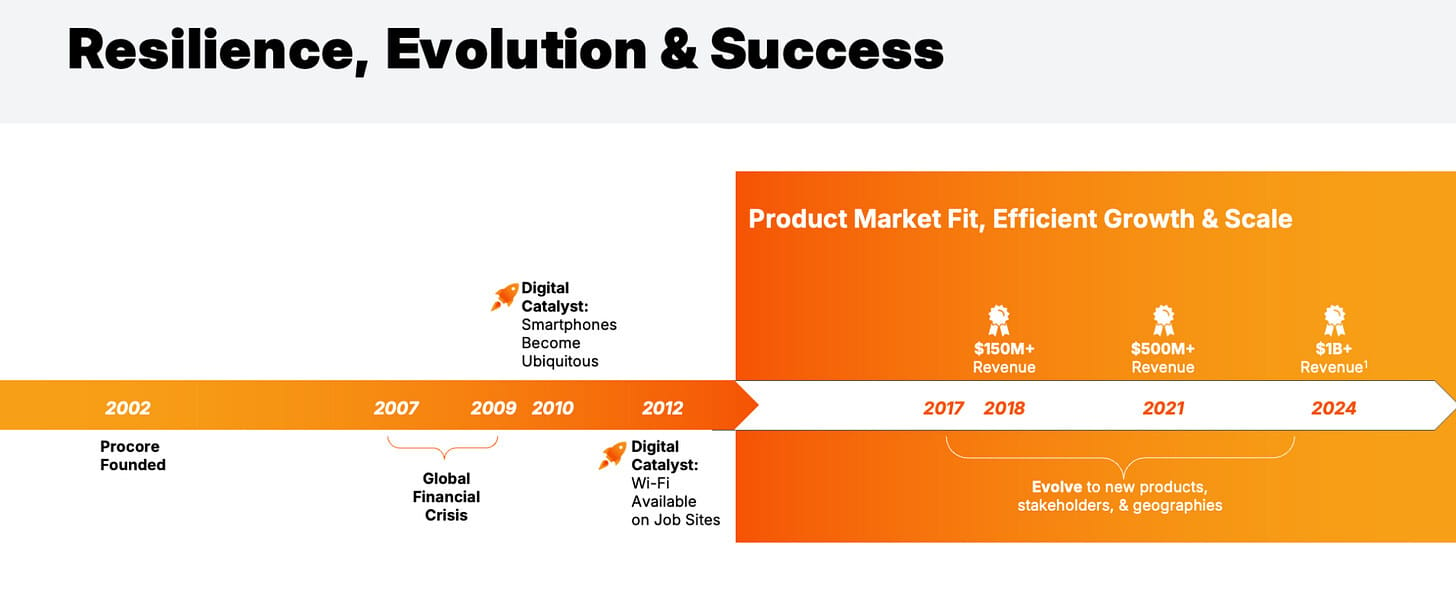

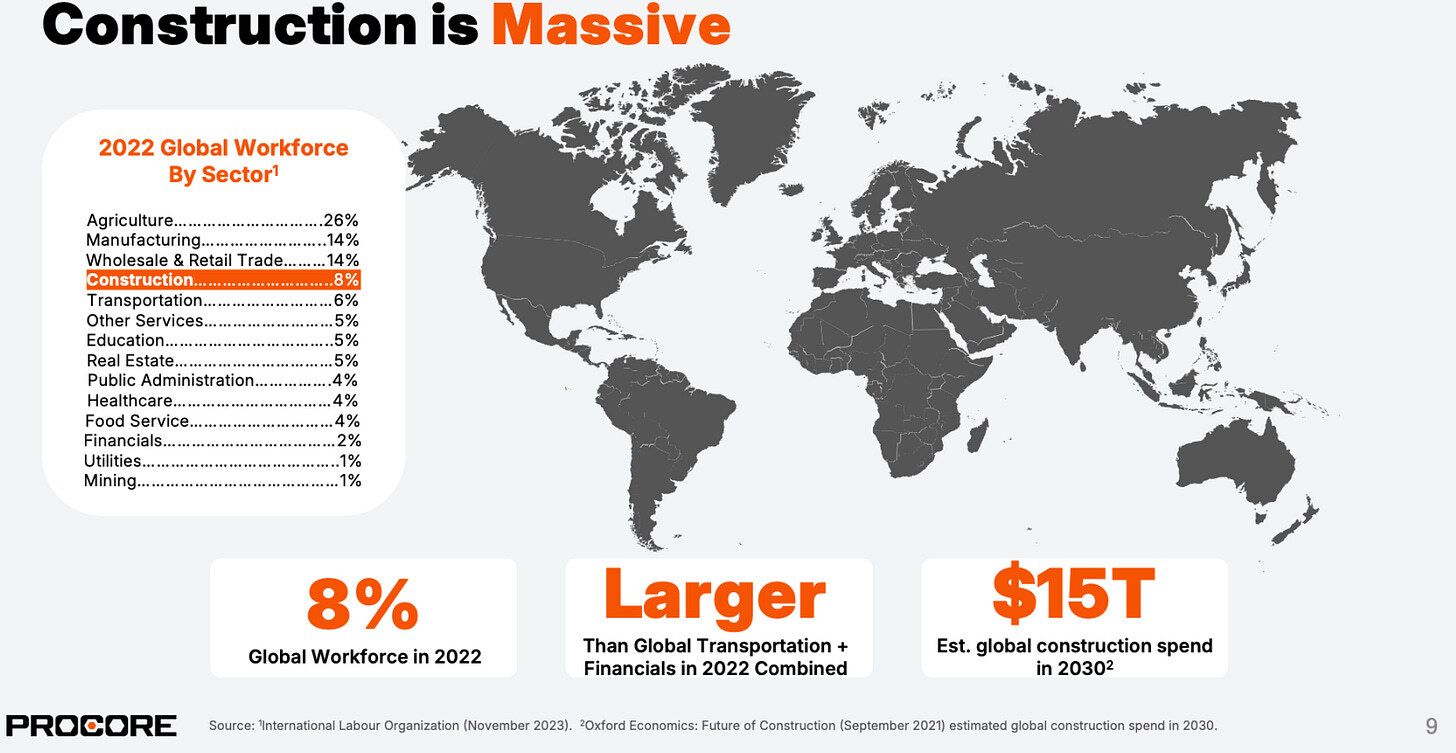

Procore

Went from project management SaaS for SMB construction companies to complete job site operating system

Initial TAM: Scheduling and documentation tools for mid-size general contractors

You’d think their TAM was: Vertical SaaS in a slow-moving, highly fragmented industry

How they expanded: Once embedded in scheduling, RFIs, and drawings, Procore layered in financials, safety, field productivity, and eventually owner-side workflows.

Why it worked: They did not try to jump industries. They expanded across roles and workflows within the same customer base.

Procore earned the right to sell more by making the first wedge indispensable.

Toast

Went from restaurant POS terminals to full stack restaurant fintech

Initial TAM: POS software and hardware for independent restaurants

You’d think their TAM was: Crowded, low-margin, dominated by legacy incumbents

How they expanded: From POS to payroll, capital lending, online ordering, loyalty, and inventory. Now building the financial rails for restaurant operations.

Why it worked: Toast didn’t change customers; they deepened their product within the same buyer, turning payments into platform.

Toast proved TAM growth can come from ARPU expansion, not just net new customer acquisition.

Axon (formerly Taser)

From weapons (yes, they literally made tasers) to SaaS for public safety

Initial TAM: Non-lethal weapon systems for law enforcement

You’d think their TAM was: Low-growth, hardware-constrained, regulated market

How they expanded: Introduced body cams, then built cloud software for digital evidence, case management, and transparency tools.

Why it worked: Axon used its hardware footprint to launch a recurring SaaS business inside public safety agencies.

Axon showed how a narrow TAM can be a strategic high ground to launch new products. But you need to be there to learn. And those net new products may be much higher margin that your insertion point.

The Investor Lens: Why This Matters in PE

Private equity firms love large TAMs because they make the math easier. But smart investors understand that TAM alone doesn’t create exits.

Half the world is men. Big market! But that doesn’t mean every “men’s product” is instantly fundable. There are enough testosterone replacement products out there.

What matters is how much of that TAM a company can realistically serve, and whether that serviceable market is expanding or shrinking, both due to macro circumstances and the company’s deliberate positioning.

In evergreen capital models, like the one Sandesh Patnam runs at Premji Invest, TAM is treated as a starting point. The more important question is whether the company will be more obvious in five years than it is today. That requires durability, and product necessity, not just “high level market size”. It requires an expanding right to win, not a static, academic definition of potential.

This is a useful shift for PE-backed CEOs, CFOs, and CPOs to internalize. The exit story is not about how large the market was when you started. It is about how much you bent it in your direction.

Final Thought

TAM is actually most useful as a scorecard for execution. Not a theoretical “what if,” but a real-time reflection of how well your company is earning its place in the market. And on a micro level, you can measure and validate that within a single customer account.

If your TAM hasn't grown since last year’s board meeting, ask if you’re trying to chase a paper market, or build into a living, and expanding, pie. And if you're still quoting the same research report from three years ago, you probably don’t have your own opinion on where the market is going and how you’re building a product to both drive the change and capture the value creation.

TAM is not something you inherit.

It is something you earn.

Premji Invest is an investment firm that backs some of the biggest names in the CFO and enterprise tech stack, including Anaplan, Zuora, Coupa, and Looker. In this episode I’m joined by Sandesh Patnam, a Managing Partner, to discuss their approach to investing and the future of CFO tech.

We discuss:

What ‘evergreen capital’ is

How this permanent pool of capital enables the company to focus on deep partnerships and durable growth, rather than chasing fund cycles or portfolio diversification.

Why he views total addressable market (TAM) as a floor rather than a ceiling

How investing across both public and private markets creates a strategic advantage

How startups should approach capital construction and optionality in today’s market.

Thanks for reading, and make sure to check out our sponsor, Finqore. You ain’t gotta get ready if you stay ready for a fundraise or exit. Download their white paper on the perfect data cube.