We all know that bad data in = bad data out.

When contract data is unstructured, everything downstream suffers.Manual billing and invoices, messy spreadsheets, and hours of reconciliation that never quite tie out.

Tabs fixes that.

We’re the AI-native revenue platform that automates the entire contract-to-cash cycle. Whether you're selling custom terms, usage-based pricing, or a mix of PLG and sales-led, Tabs turns month-end chaos into clean cash flow.

✅ Instantly generates invoices and revenue schedules from complex contracts✅ Automates dunning, revenue recognition, and cash application✅ Syncs clean, structured data across your ERP and reporting stack

Trusted by companies like Cortex, Statsig, and Cursor, Tabs powers the finance teams behind the next wave of category leaders.

👋 Hi, it’s CJ Gustafson and welcome to Looking for Leverage. Each edition dives into the real-world playbooks PE-backed execs use to drive results.

Today we’re talking about using non-standard definitions of ARR, and how it can lead to unexpected mark downs by investors during financing events. If you sell multi year deals, this post is for you.

What is CARR? It stands for Contracted Annual Recurring Revenue.

You see, in software land, you can sell multi year contracts. And the first year may not be the same value as, say, the third year.

Many companies will claim the larger, exit year Contracted ARR (CARR) as ARR. However, CARR will not track to current period GAAP revenue or billings.

Why does this disconnect exist in the first place? There are a few reasons:

First year discounting: You offer a customer 25% off in the first year, and then return to the base price for the out years, decreasing the revenue you actually get in year one.

License ramp: You negotiate for the contract to increase in license count over time, with the objective of aligning to the customer’s anticipated headcount growth, hence increasing the revenue you get in the out years.

Embedded price increases: You add in a lever for inflation that kicks in during subsequent years, increasing future contracted revenue.

The net effect of all this is it creates a perverse incentive to quote the largest annual total of the bunch. It effectively overstates the amount of business you will actually collect cash on in the current year, as well as the actual GAAP revenue you’ll record and track to.

Buuuuuuut… it makes you look better than you are at the moment! Which is why companies who fundraise often do it. It increases both the total annual recurring revenue you can tell investors about, and it artificially boosts your year-over-year growth rate. You look all dolled up for the fundraising gala.

Now, CARR can be useful in the sense that it essentially shows you the revenue you’ve de-risked down the line. But savvy accountants would argue that you can just get that from RPO (Revenue Performance Obligation) and cut the crap. Speaking of that…

RPO

For all those unfamiliar with this space man term, RPO is all unrecognized contracted revenue.

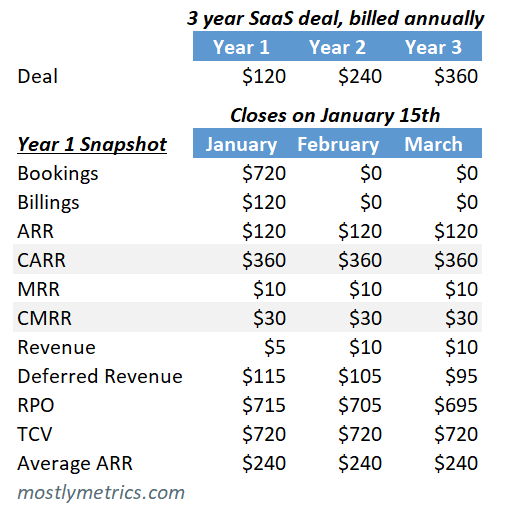

Deferred revenue goes out at most 12 months, so RPO was created to extend even further to capture all of a multi year commitment. It includes both Deferred Revenue and any unbilled portion of a multi year contract.

For a 3 year contract you’d have 12 months in deferred revenue and 36 months in RPO. Of the 36 months, 12 months would be current RPO and 24 months would be non-current RPO.

RPO is not a GAAP number and, therefore, does not appear on the balance sheet. Instead, companies report it in the “Revenue from Contracts with Customers” section of their public filings to make sure they get “credit”.

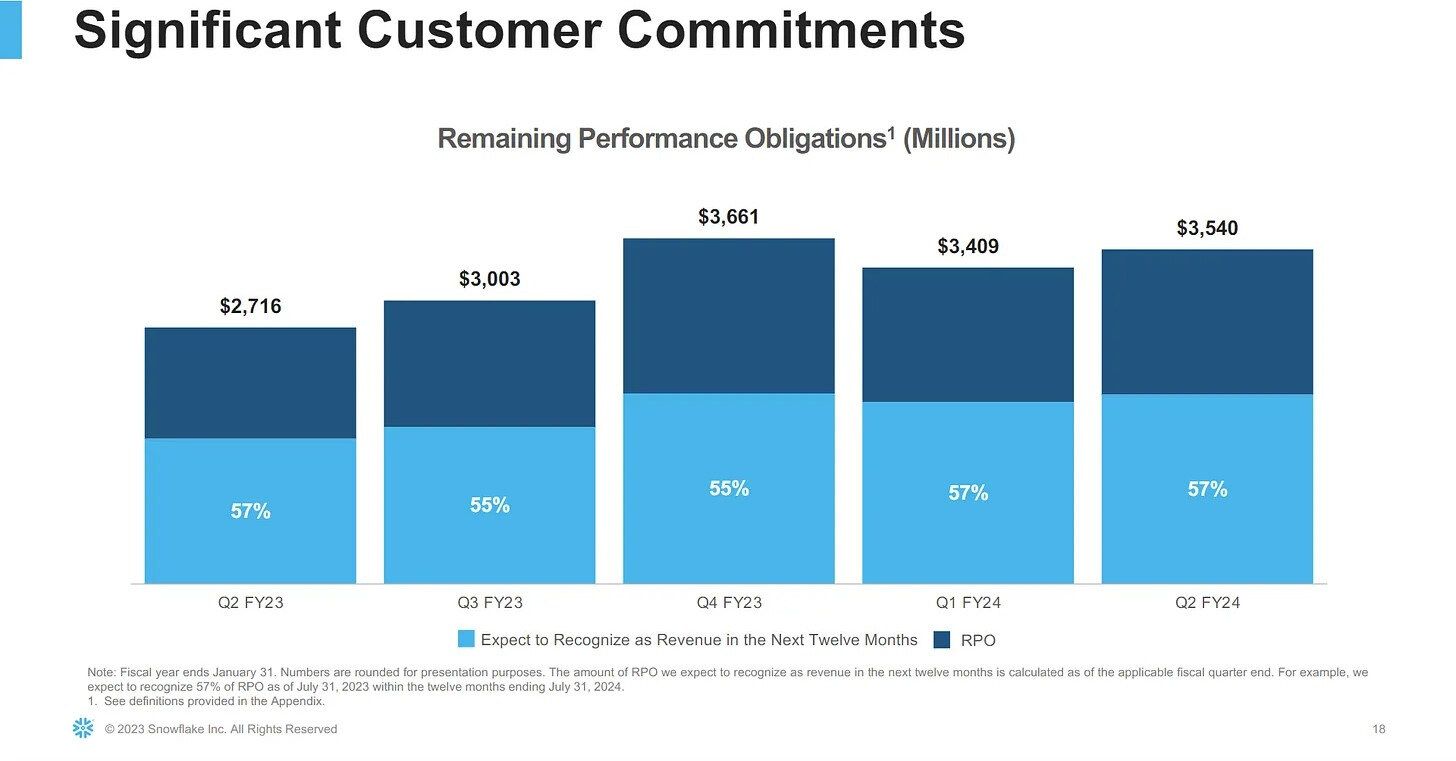

It’s really popular for consumption based businesses where customers pre-pay, or commit, to lots of usage.

This is how Snowflake, everyone’s favorite consumption company, defines RPO:

Remaining performance obligations (RPO) represent the amount of contracted future revenue that has not yet been recognized, including (i) deferred revenue and (ii) non-cancelable contracted amounts that will be invoiced and recognized as revenue in future periods. RPO excludes performance obligations from on-demand arrangements and certain time and materials contracts that are billed in arrears. Portions of RPO that are not yet invoiced and are denominated in foreign currencies are revalued into U.S. dollars each period based on the applicable period-end exchange rates. RPO is not necessarily indicative of future product revenue growth because it does not account for the timing of customers’ consumption or their consumption of more than their contracted capacity. Moreover, RPO is influenced by a number of factors, including the timing and size of renewals, the timing and size of purchases of additional capacity, average contract terms, seasonality, changes in foreign currency exchange rates, and the extent to which customers are permitted to roll over unused capacity to future periods, generally upon the purchase of additional capacity at renewal.

Thanks, Frank!

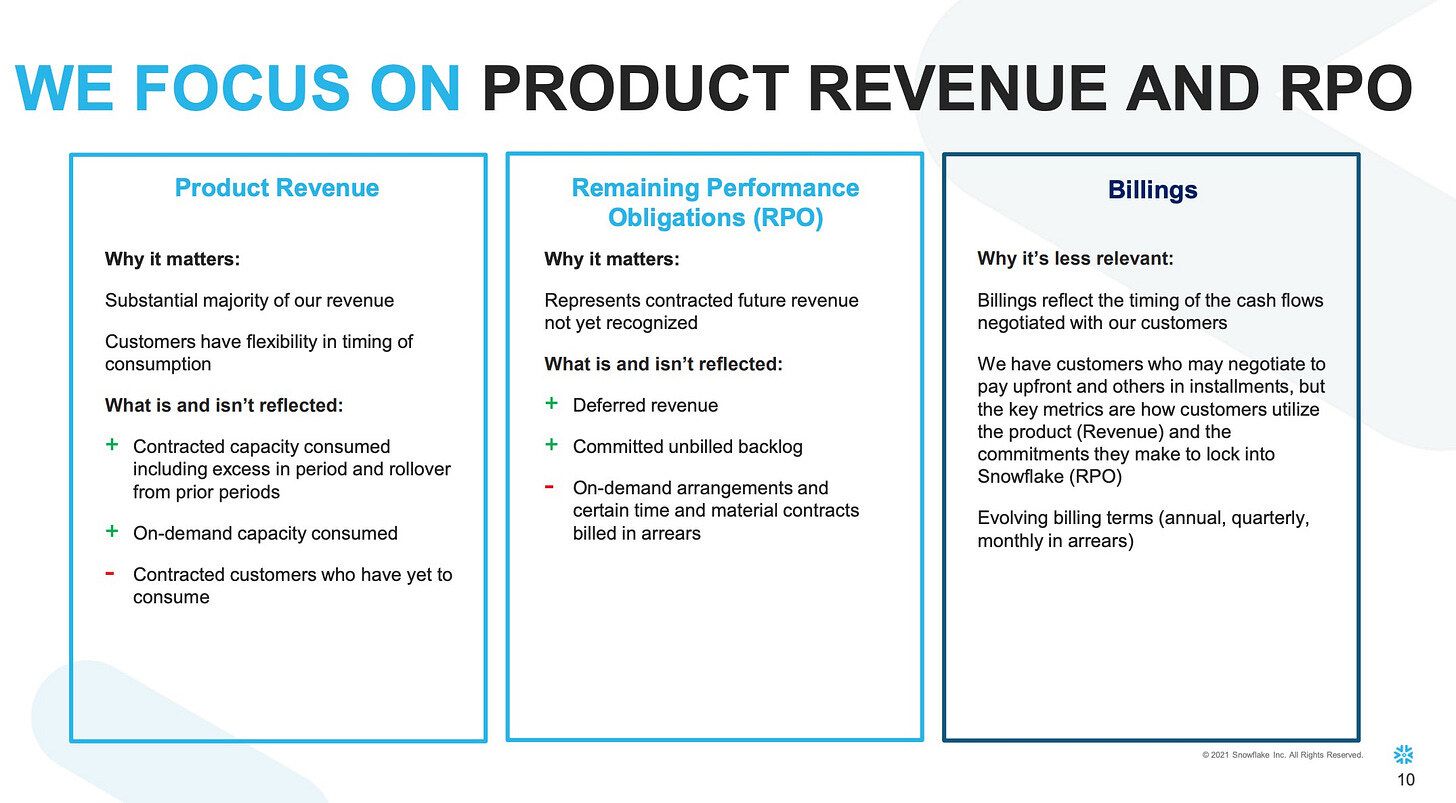

Snowflake is adamant about “not being a SaaS business.” Customers pay for credits and compute. And RPO is the best future indicator for their business model in terms of where the puck (or consumption) is going. Here’s their rationale:

Back to our scheduled program on the dark arts of CARR…

How you get caught

Eventually there will be a quarter when your investors looks at your reported GAAP revenue, then look at your CARR, and then scratch their heads at the gap (not GAAP) between the two. You see, ARR should track revenue pretty closely.

And if you are growing really fast, and keep adding multi year deals to your pile, the CARR will deviate more and more from your revenue. You become a victim of your own success in this sense, as the gap widens.

And since companies are valued based on a multiple of revenue (sometimes ARR, but most deffff not CARR), investors will feel like they were duped.

And to make matters worse, the cash forecast they made during their due diligence will be off if they were using revenue and billings (which now don’t match CARR) as proxies for cash flow. So double not good.

You’ll inevitably need to come clean, or play dumb, and do a big restatement. And confronting that breach of trust is never fun. Trust me, I’ve been there.

Comparing the different cuts

Here are all the ways I could think of to show a standard 3 year SaaS deal that doubles in price each year. It closed on January 15th.

Think twice before you CARR

Using a non-standard definition of ARR can lead to unexpected mark downs by investors during financing events.

Plus, as an operator, re-defining a key metric like your topline growth can cause frustration. It’s almost like you take a hair cut to the progress you thought you had already achieved. Imagine being at $102M in “ARR” and then dropping back down to $86M purely due to how you were adding shit up. That would suck.

So think twice before you CARR.